Regret nothing

My first-ever blogpost that is based on a book I just read, "Die with Zero" by Bill Perkins. At glance, this blog's title might not directly related to the book's content. However, as you read along, it will reveal why this book is not (always) about "how to die with zero money", but more about "how to do things that make you regret nothing". Read on if you're curious.

To start off, here's the premise of the book:

A person's ability to extract the full enjoyment from their money begins to decline with age.

Let's understand and validate the above statement in the next few paragraphs. I'll convey my take on this book in non-traditional way; rather than following the book's flow, I am taking another approach which is based on the life's stage: chronologically.

Disclaimer

I intentionally "cherrypick" the topics I talk about in this post as there are just too many things I can't comprehend in a single-post. Yet this doesn't mean the whole idea of the book isn't covered, it's just that some of the nitty-gritty details aren't talked here.

Early career

Let's imagine we're in our early career of our professional life. Typically, we would focus on the "survival" aspect of life first. This includes the basic need of human: place to live, food, and clothes (read more about Maslow's Hierarchy of Need). The idea is to build a solid foundation so that we can start accumulating wealth and then also enjoy our life to the fullest.

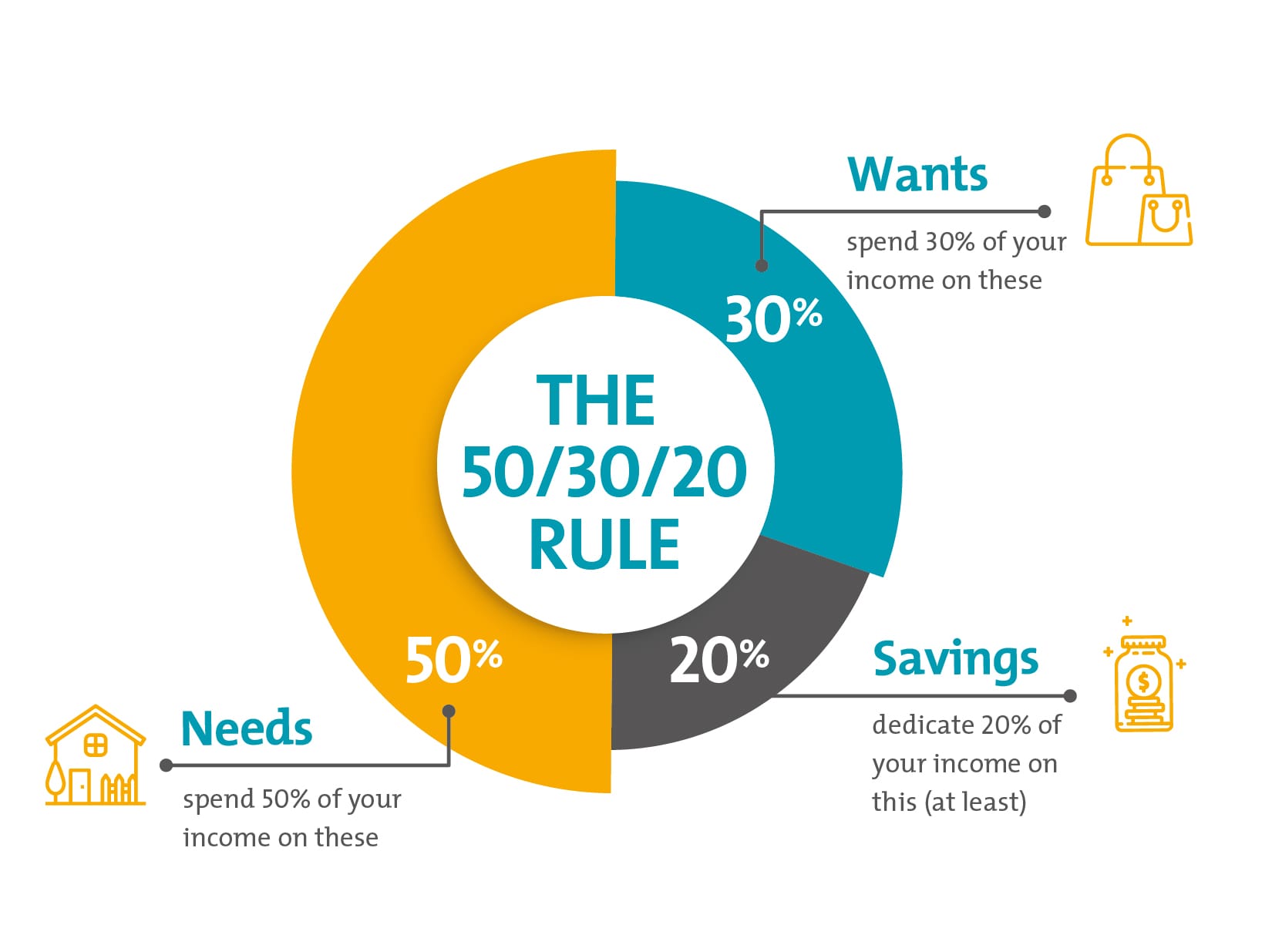

Financially, we would allocate our income into the 50:30:20 budgeting rule:

- 50% of our income goes to the essential needs like housing, transportation, food, and clothes (needs)

- 30% of our income goes to pleasure such as vacation, shopping, and entertainment (wants)

- 20% of our incomes goes to the saving, i.e. emergency fund, deposit, stock, mutual fund, and many others (savings)

This looks conventional although it is without a doubt really good rule that has been passed down from generations to generations and is followed and practiced by many people. Except that this rule isn't actually something set in stone. The book says that this is a good starting point though we don't have to apply the rule forever.

We instead need to constantly evaluate the "budget allocation" for each post, make it flexible from time to time. For example, rather than "only" allocating 30% of our income to the "wants" post, the author proposes to increase that allocation while our body is at its maximum performance to enjoy it. And this is tightly-related to what I want to talk about next.

Resources of life

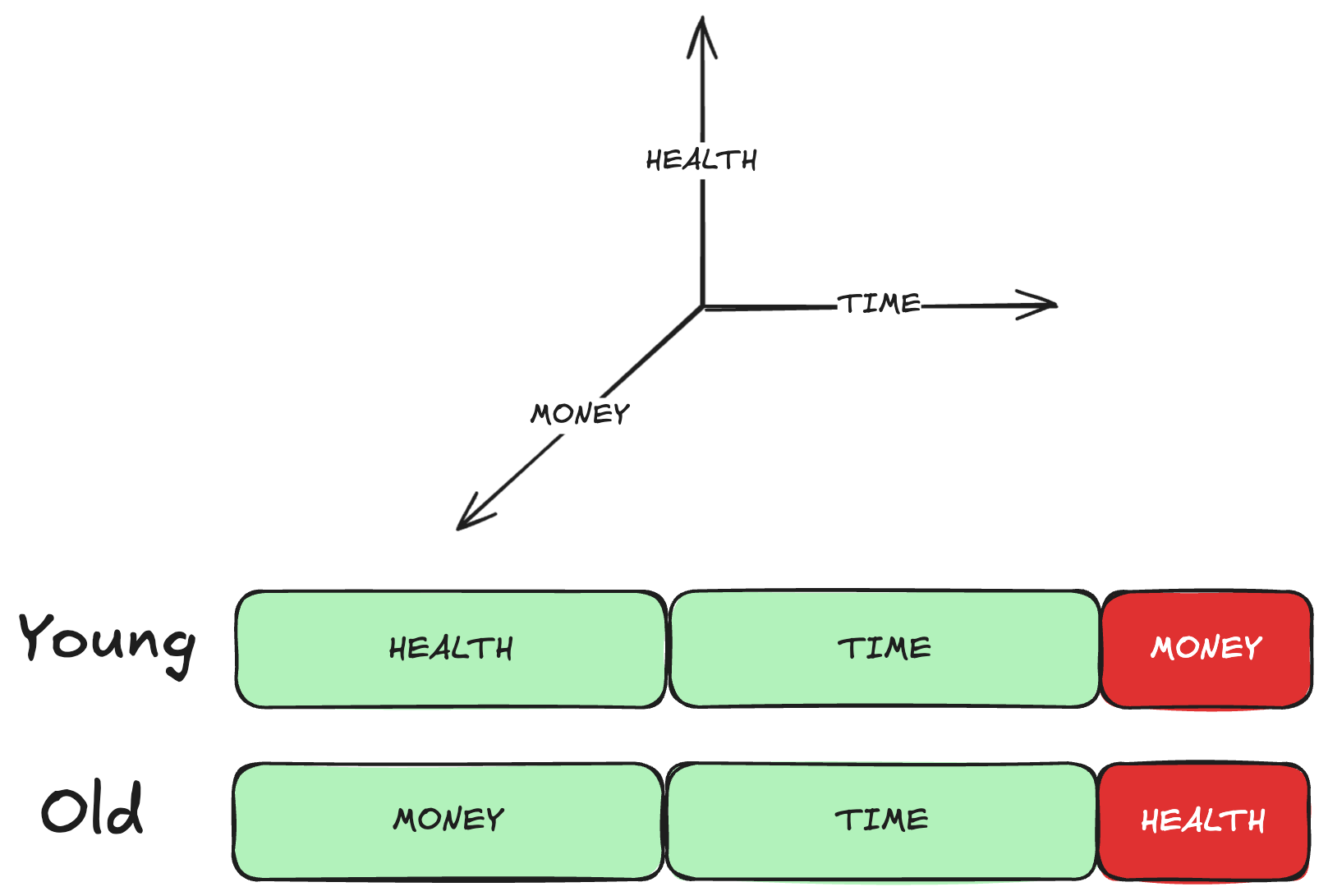

In general, we have the following "basic resources" in life:

Time

As we all know, time is irreversible resource. Once it passed, we can't "go back" to the past. Likewise, we can't "go forward" in the future. So it's really the one-of-a-kind most rare "commodity".

Health

On the other hand, health depends on many factors: gene, food, lifestyle, and many more. But one thing for sure: our health declines as we age.

Money

And comes the last resource: money. Something majority of people accumulate throughout their lifetime yet it is "just" a means to an end; Money isn't everything but most of the things can be "bought" with money.

When we were young, we got an abundant of time and health but with relatively small amount of money. Going into adult life, we start to earn a lot of money but are busy with family, children, colleagues, and work. We also still have a quite good health assumed we maintain our physicality. And then later in the old days, normally, we accumulate lots of money, have a big chunk of free time, yet start experiencing significant health decline.

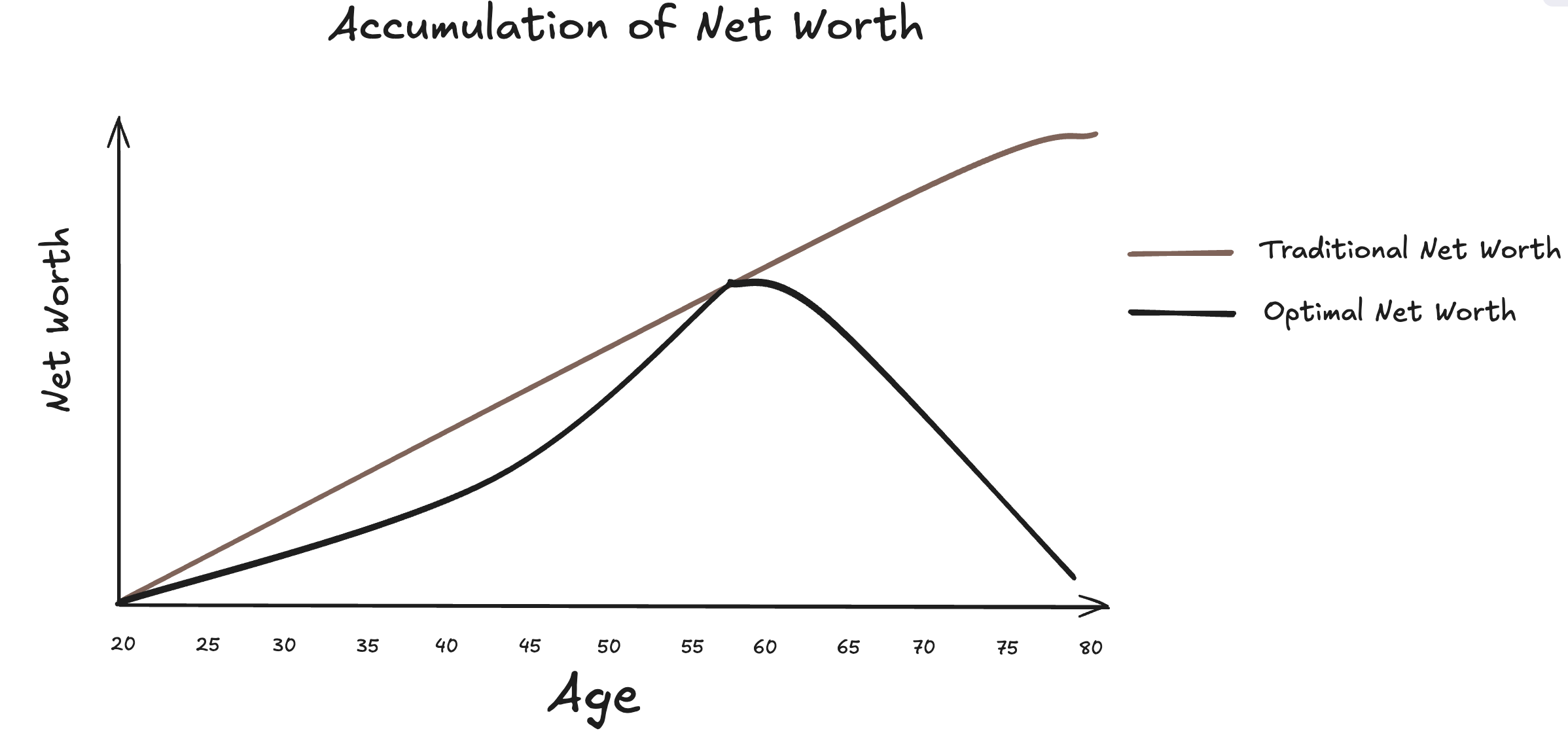

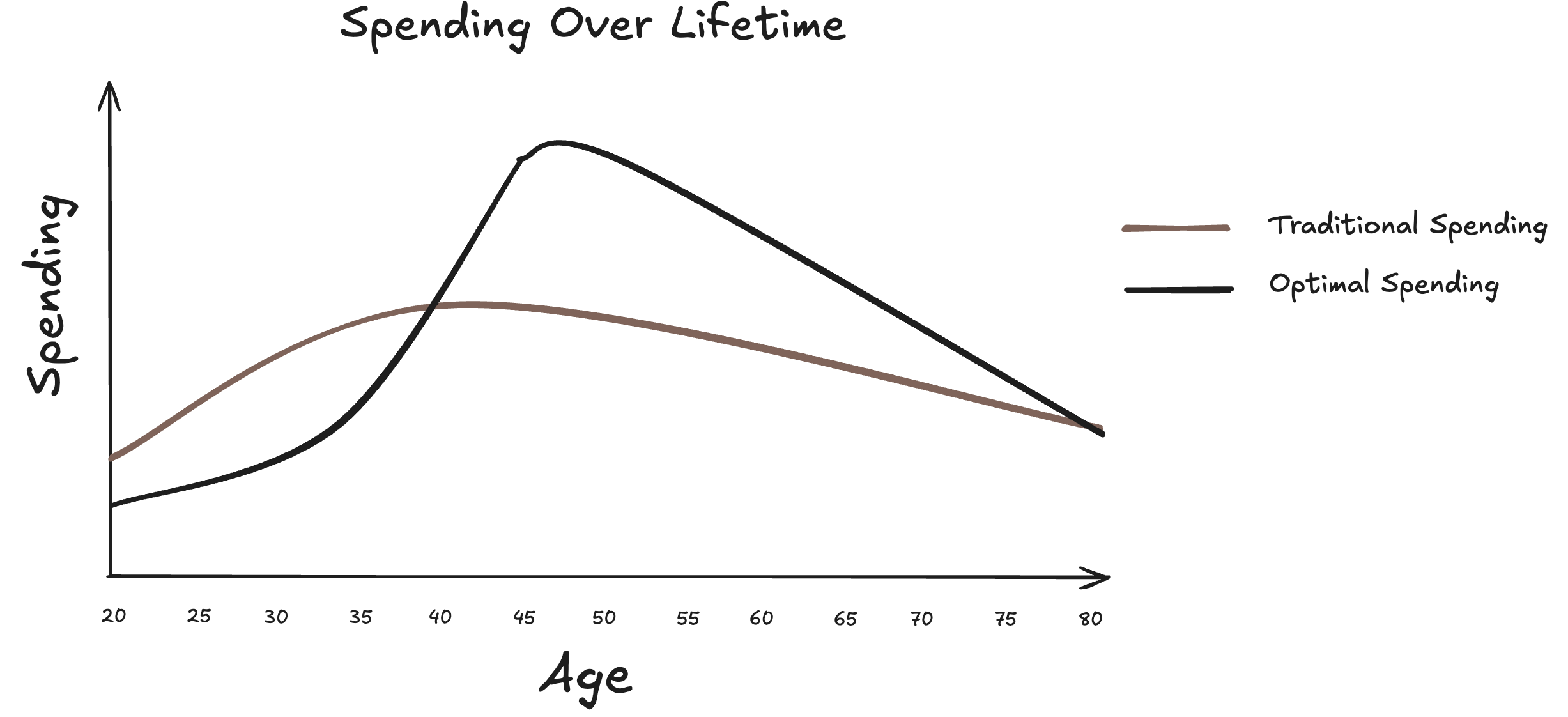

Following that statement, the 50:30:20 rule should be based on the "concentration" of those basic resources. This book suggests that instead growing money non-stop that lead to "high-wealth, low-health", we should "stop" growing our money at some point and start performing wealth-spending activity as soon as possible. See the following chart that compares between the "traditional net worth" vs "optimal net worth".

I kind of agree with the above "optimal net worth" though. An idea where the author says that we should try to stop our wealth-accumulating activity at certain point in life and start wealth-spending activity. That's because there are some money-oriented activities that are best to be enjoyed while we're young whilst in the old days, there are certainly less of that.

Memory dividend

The ultimate goal is to have as much experience as possible that we can enjoy when we still have the peak energy and money, which eventually create lasting memory. Bill called this "memory dividend", a similar concept to the "traditional dividend". But instead of getting more money or stock, we'll get "memory" to remember when we have done all those experiences in a time we could enjoy it the most with our loved ones.

On a personal note, I did fully enjoy my time with my family and relatives when I organised a 4-day staycation post-covid (circa 2021) when I was still single and live nearby, thus had flexibility to do so. I know it took quite amount of money but it was totally worth it and I regret none of it. That wouldn't be possible today as I am currently living abroad.

That kind of thing, the one that should (ideally) happen at certain stage of our life, with optimum flexibility, autonomy, and amount of money, is the now-or-never experience this book has been talking about and arguably one of the key takeaways the author wants from the reader to take a note of.

Declining rate

It's inevitable that our organ's ability declines as we grow old because that's basically how human lifecylce is. From baby, we increase our capability and typically reach the peak during the prime time (20-ish to 30-ish) and later our health declines. And those are the things that are out-of-control.

Despite of that, there's one thing that we certainly can control: declining rate. This is basically just saying that we could "slowdown" the aging by investing more in our health right from our young days. Because, generally if we are in a good health, it will make our life's enjoyment better than if we aren't.

Conclusion

The book is not always about "how to spend your money until zero before you die". Rather, it's about how we can make use of our limited resource—time and health—using money in the best possible way so that we will "regret nothing". Therefore, I have 2 actionable next actions:

Time-bucket list

Organise our "bucket list" into more specific age-group, i.e. in our 30-40s we want to A, B, C things and in our 50s-60s we want do X, Y, Z things, and so on. This will make our life's goals more enjoyable, rather than the general bucket list with no age-bound information. I am sure we won't be enjoying traveling around the world if we're in our 70s compared to if we're still in our 30s or 40s, right?

Invest more in health

Obviously, we can do much more when we're health vs sick. Even with small amount of money, we can still have a wide range of activities when our body is at its optimum condition. In contrast, even with huge amount of money, if we're sick, that seems pointless. In that regard, I won't be much more hesitant as I was before to spend money to "prolong" my health.

If you're interested to know the details and want to get the most of the book, here's the link to buy!